Lighthouse Allows You to Approve New Buyers in Minutes – and Monitor Existing Buyers’ Payment Behaviors

Offering buyers payment terms is a common practice in B2B. But it's a practice that causes tension, as it forces food and beverage vendors to act as lenders for their buyers. And if a buyer pays late – or doesn’t pay at all – vendors are left holding the bag.

→ More: Why do restaurants & retailers pay some vendors faster than others?

The missing piece

A typical vendor offers 14-30 day payment terms. But the average buyer pays late, and the reasons behind the late payment range from sloppiness and poor processes to cash flow challenges.

Trade and bank references offer vendors a snapshot of a buyer’s ability to pay. Even when trade references are automated through platforms like Wholesail, it can take a few days for vendors to respond to the reference request. Automated bank references, such as those provided through Wholesail, give instant visibility into the buyer’s financial position – but this information doesn’t necessarily communicate how that buyer will pay you.

Buyers feel this friction, too. They are forced to build credit one vendor at a time, which often starts with very short terms or cash-on-delivery. Personal guarantees are common.

Deciding whether a buyer is creditworthy takes time. It slows sales for vendors and delays orders for buyers.

→ More: Why an efficient credit application process matters for food & beverage distributors

A better way, thanks to real-time credit exchange

Meet Lighthouse

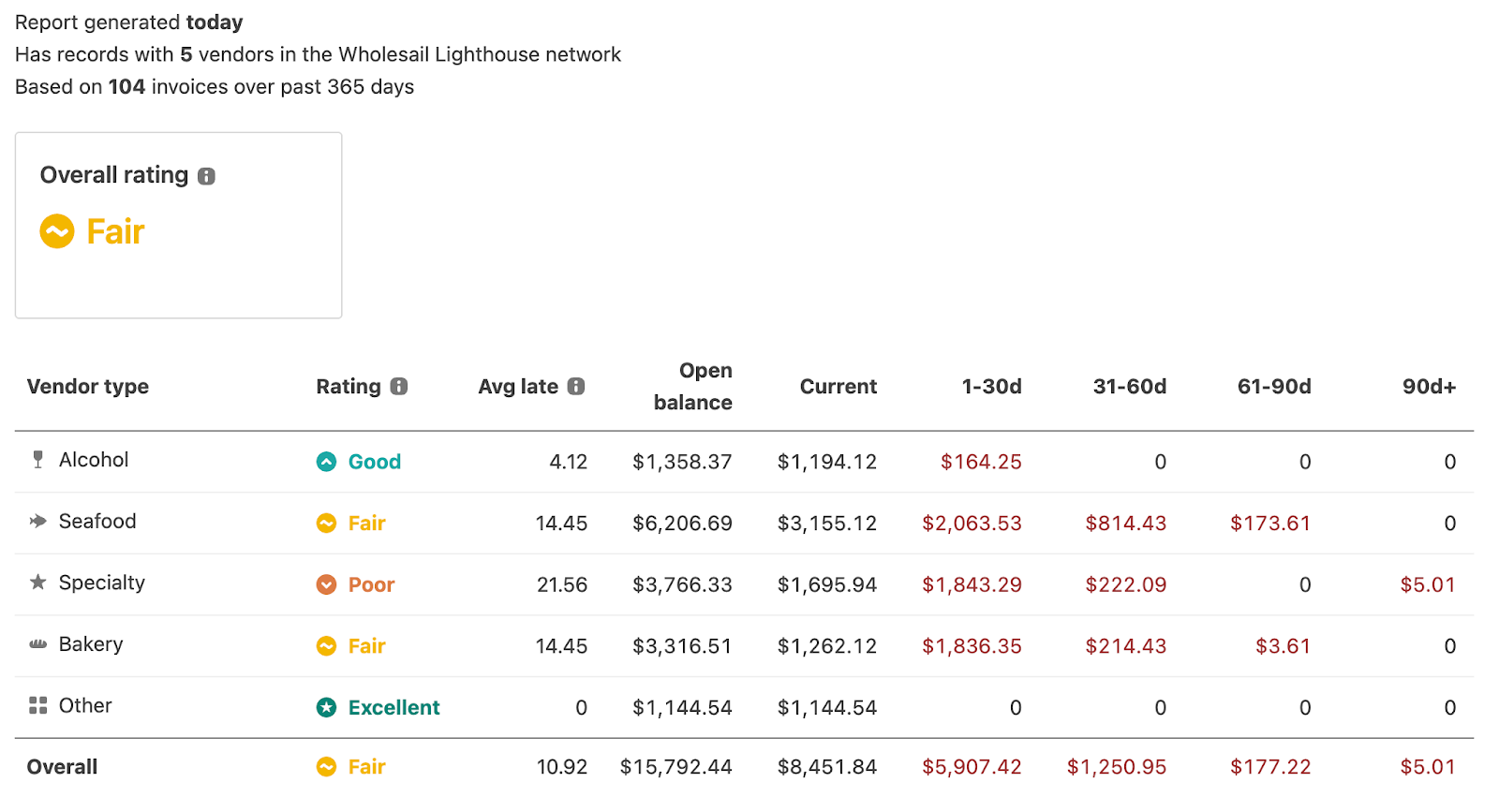

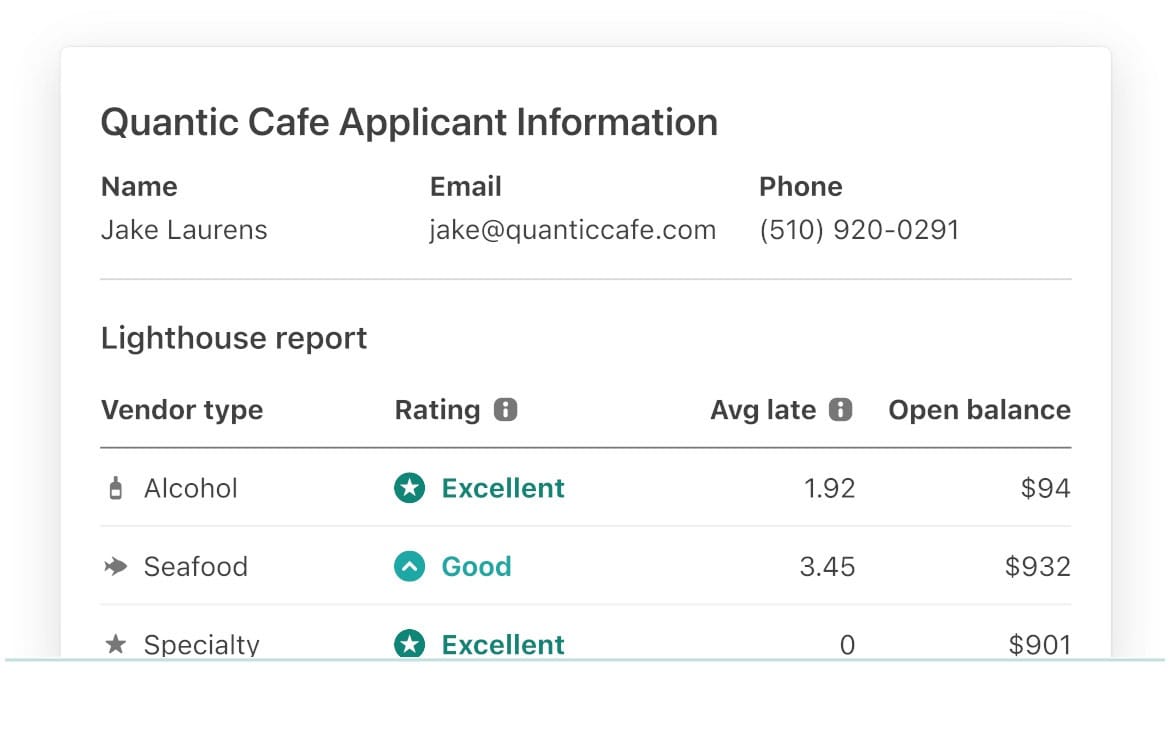

Lighthouse is an anonymous exchange of buyer payment history for the food and beverage industry. It allows you to make quicker decisions about new customers while monitoring your existing accounts – with facts, not guesswork.

What Lighthouse provides:

- Daily updates about payment behavior across the network

- Coverage for prospects and customers in your market

- Instant context on new buyers (i.e., see how they pay other vendors before you set terms)

- Early warnings on your portfolio (i.e., Lighthouse will flag when a customer starts slipping elsewhere)

How Lighthouse is different from traditional credit bureaus:

- Reciprocal data sharing, meaning anyone who accesses data must also share their data

- Daily reporting offers continuous monitoring, differing from one-time credit checks

- Real-time market information based on geography so the network gets stronger as more peers join

Grow your business with confidence by reducing risk

Better data lets you extend the right terms to every customer – faster.

Great credit ➡️ Instant terms without personal guarantee

Average credit ➡️ Vary approach based on risk tolerance

Bad credit ➡️ Require Autopay, ACH/CC on delivery, or personal guarantee

Four Ways Lighthouse’s Data Helps Your Team

- Reduce losses. Lighthouse improves visibility so that you can lower exposure to risky customers.

- Save time. A/R gets clear visibility to onboard and manage accounts without endless back-and-forth.

- Grow sales. Offer longer terms and higher limits to the right customers, increasing order size and loyalty.

- Elevate customer service. Be the fastest vendor to approve terms – no more waiting for weeks.

Lighthouse helps you lower risk – and it gives you the confidence to have less restrictive credit policies that can help grow the business.

→ More: Do Your Company’s Credit Terms Impact Your Buyers’ Behavior?

Data Protection, By Design

Lighthouse is built to protect contributor privacy and the integrity of sensitive business data.

- Opt-in only. Participation is optional, and participants must opt-in.

- Usage restrictions. Data can be used only for credit risk decisions – not marketing, prospecting, or competitive intelligence.

- Confidential and anonymized. We never reveal the vendors that contribute buyer data; shared market intelligence is anonymized.

- Launch with density. Markets go live only when there’s sufficient participation to preserve anonymity.

- No resale of raw data. Wholesail never shares identifiable records with other distributors or third parties.

Lighthouse + Wholesail

Wholesail’s platform already allows vendors to onboard new customers with confidence, using custom forms that fast-track your credit application and onboarding processes.

- Capture instant bank data, trade references, signed terms, and more.

- Reduce payment risk by requiring Autopay or a payment method on file from the start.

- Buyers connect their bank account to instantly share historical balance and net cash flow.

- Leverage up-to-date financial info instead of incomplete bureau data.

Lighthouse expands our ability to help you reduce risk and grow with confidence.

What to Expect

Over the next few months we’ll be expanding Lighthouse in every dimension:

- Expanding coverage. We’re onboarding more distributors and service providers that sell to restaurants and retailers which expands our network coverage. Help us spread the word, as broader participation benefits everyone.

- Connected entities. Linking related businesses (shared ownership or legal entities) to expand visibility when extending credit terms for new businesses.

- Predictive insights. An AI-based risk model helps distributors predict who might be at risk of defaulting, plus recommendations for terms to consider imposing based on this information.

If you’re ready to confidently approve credit terms in minutes – not weeks – Lighthouse can help.